In today’s rapidly evolving financial landscape, achieving financial wellness has become crucial for Millennial and Gen Z professionals. As you navigate the complexities of budgeting, student loans, and investments, remember that understanding your financial health empowers your future. By embracing financial literacy and developing smart strategies, you pave the way for stability and success. This journey not only fosters peace of mind but also enables you to dream bigger and achieve even greater milestones. It’s time to take control of your financial destiny and unlock the vibrant possibilities ahead!

Understanding Financial Wellness: A New Perspective

Financial wellness transcends mere financial stability. It embodies a holistic approach to managing your resources effectively while nurturing your mental and emotional well-being. For millennial and Gen Z professionals, embracing this concept is pivotal in creating a secure future.

Key Elements of Financial Wellness:

- Knowledge: Understanding personal finance equips you with the tools to make informed decisions.

- Budgeting: A well-crafted budget aligns your values with your financial choices, ensuring you allocate funds wisely.

- Debt Management: Effectively managing and reducing debt fosters a sense of control and reduces stress.

- Savings and Investments: Cultivating a habit of saving and investing sets the stage for long-term financial security.

To illustrate, consider this comparison of traditional financial stability versus comprehensive financial wellness:

| Aspect | Traditional Financial Stability | Financial Wellness |

|---|---|---|

| Focus | Earnings vs. expenses | Balance of earning, spending, and well-being |

| Approach | Reactive management | Proactive goal setting and planning |

| Mindset | Surviving | Thriving |

By shifting our perspective to encompass financial wellness, we set ourselves up for not just survival but genuine prosperity. When you prioritize your financial health, you’ll find greater peace of mind and the freedom to pursue your true passions. Invest in your financial wellness today, and unlock the doors to an abundant future.

The Importance of Financial Literacy for Young Professionals

In our fast-paced world, understanding how to manage your finances effectively is crucial for achieving financial wellness. Young professionals, particularly Millennials and Gen Z, face unique financial challenges. Thus, acquiring financial literacy becomes paramount for long-term success. Here are some compelling reasons to prioritize this knowledge:

- Empowerment: Financial literacy equips you with the tools to make informed decisions. Knowing the basics of budgeting, savings, and investments reduces dependency on others and boosts your confidence.

- Debt Management: In today’s economy, student loans and consumer debt can be overwhelming. A strong grasp of financial principles allows you to create effective repayment strategies, ensuring you maintain your financial wellness.

- Goal Setting: Financial literacy helps you articulate and pursue financial goals. Whether it’s saving for a vacation or planning for home ownership, you’ll know how to map out the necessary steps.

- Investment Knowledge: Understanding various investment opportunities can pave the way for wealth accumulation. Learning the risks and rewards associated with investments is essential for securing your future.

- Avoiding Financial Mistakes: With knowledge comes the ability to navigate pitfalls. Educated decisions help you avoid scams and high-interest debt, further enhancing your financial wellness.

By embracing financial literacy, young professionals create a solid foundation for their financial future, ultimately leading to a more secure and fulfilling life.

Budgeting Basics: Crafting Your Financial Blueprint

Establishing a solid budget is essential for achieving financial wellness. It serves as your financial blueprint, guiding you toward your goals while helping you navigate life’s unexpected challenges. Here’s how you can create an effective budget:

- Understand Your Income:

- Calculate your total monthly earnings, including salaries, side hustles, and passive income.

- Track irregular sources of income to get a clearer picture.

- Track Your Expenses:

- Fixed Expenses: Rent, utilities, insurance.

- Variable Expenses: Groceries, entertainment, dining out.

- Discretionary Spending: Non-essentials that can be reduced if needed.

- Set Your Financial Goals:

- Short-term goals (saving for a vacation).

- Medium-term goals (buying a car).

- Long-term goals (saving for retirement).

- Create Your Budget:

- Use tools like spreadsheets or budgeting apps.

- Allocate income into categories while prioritizing savings and necessary expenses.

- Review and Adjust Monthly:

- At the end of each month, assess your spending.

- Adjust your budget if you overspend or find areas for saving.

Creating your financial blueprint will empower you. By focusing on financial wellness, you can alleviate stress and build a secure future. Remember, budgeting isn’t about restriction; it’s about freedom and making informed choices. So, take control of your finances today!

Navigating Student Loans and Debt Management

Managing student loans is a crucial aspect of achieving financial wellness for Millennials and Gen Z professionals. With education costs soaring, understanding how to navigate these loans can alleviate stress and foster a secure financial future. Here are some practical strategies:

- Know Your Loans: Different loans come with varied interest rates and repayment terms. Familiarize yourself with:

- Federal loans: Often have lower interest rates and more flexible repayment options.

- Private loans: Typically require more stringent credit requirements and may carry higher interest rates.

- Create a Repayment Plan: Following are some repayment options to consider:

| Repayment Option | Pros | Cons |

|---|---|---|

| Standard Repayment | Fixed payments, simpler to manage | Higher monthly payments |

| Income-Driven Repayment | Payments based on income, offers relief | May extend repayment term |

| Forgiveness Programs | Potential loan forgiveness after years | Often comes with specific conditions |

- Budget Responsibly: Allocate a specific percentage of your income to loan repayment. Ensure you’re balancing this with other essential expenses to maintain financial wellness.

- Seek Professional Advice: If debt feels overwhelming, consider consulting a financial advisor. They can provide personalized insights tailored to your situation.

By actively managing student loans and understanding your options, you can pave the way for a brighter financial future. Remember, staying informed and proactive is key to achieving financial wellness!

Building an Emergency Fund: Security for the Future

Creating an emergency fund is a crucial step towards achieving financial wellness, especially for Millennials and Gen Z professionals. This fund acts as your safety net, providing peace of mind during unexpected financial challenges. Here’s how to start building yours:

- Set a Realistic Goal

Aim for three to six months‘ worth of living expenses. This amount ensures you’re prepared for unforeseen circumstances, such as job loss or medical emergencies. - Open a Separate Savings Account

Keep your emergency fund in a high-yield savings account. This way, it remains accessible but distinct from your everyday spending. - Automate Your Savings

Set up automatic transfers from your checking account to your emergency fund. Consistency is key! Even small, regular contributions can lead to significant savings over time. - Prioritize Your Fund

Treat your emergency fund like a recurring bill. Allocate a percentage of your income specifically for this purpose, reinforcing the importance of financial wellness in your daily life. - Reassess and Adjust

Periodically review your fund. Life changes may necessitate adjusting your target contributions, ensuring you always maintain adequate coverage.

Building an emergency fund not only boosts financial wellness but also empowers you to tackle life’s surprises with confidence. Start today; your future self will thank you for it!

Investing 101: Starting Your Journey Early

Embarking on the journey of investing can seem daunting, especially for Millennial and Gen Z professionals. However, understanding the basics of investing is crucial for achieving financial wellness. Starting early not only leverages the power of compound interest but also sets the stage for a secure financial future.

Here are some foundational steps to consider:

- Educate Yourself: Knowledge is power. Take the time to learn about different investment vehicles, such as:

- Stocks

- Bonds

- Mutual funds

- Real estate

- Set Clear Goals: Define your investment goals. Are you saving for a home, retirement, or a dream vacation? Knowing what you want to achieve makes it easier to chart your course.

- Create a Budget: Incorporate investing into your budget. Allocate a portion of your income to your investment fund every month. Just like savings, treat investing as a non-negotiable expense.

- Start Small: You don’t need a fortune to start investing. Many platforms allow you to invest with as little as $5.

- Diversify Your Portfolio: Spread your investments across different asset classes to minimize risk. A diversified portfolio can enhance your financial wellness by smoothing out returns over time.

By starting early and being intentional, you’ll not only build wealth but cultivate a mindset that prioritizes long-term financial wellness. Take that first step today, and watch your financial future flourish!

Retirement Planning: Why It Matters Now

Planning for retirement may seem distant for Millennial and Gen Z professionals, but in reality, it’s a crucial element of achieving financial wellness. Early preparation sets the foundation for a secure and enjoyable future. Here’s why getting started now is essential:

- Compounding Interest: The earlier you invest, the more your money can grow. Even small contributions today can lead to substantial savings in the long run.

- Increased Options: Early planning allows you more choices. Whether it’s selecting the right retirement accounts or diversifying your investments, starting early helps maximize your potential.

- Peace of Mind: Knowing that you’re taking proactive steps towards your future can significantly reduce financial anxiety. This peace of mind contributes to overall financial wellness.

To illustrate the importance of starting early, here’s a simple comparison:

| Age to Start Saving | Monthly Contribution | Estimated Retirement Savings (at 65) |

|---|---|---|

| 25 | $200 | $1,000,000+ |

| 35 | $300 | $600,000+ |

| 45 | $400 | $300,000+ |

As shown above, starting in your 20s versus your 40s can lead to significantly different outcomes. In conclusion, prioritizing retirement planning today is not just smart; it’s an indispensable part of achieving lasting financial wellness. Invest in your future now, and you’ll reap the rewards later!

Harnessing Technology for Financial Success

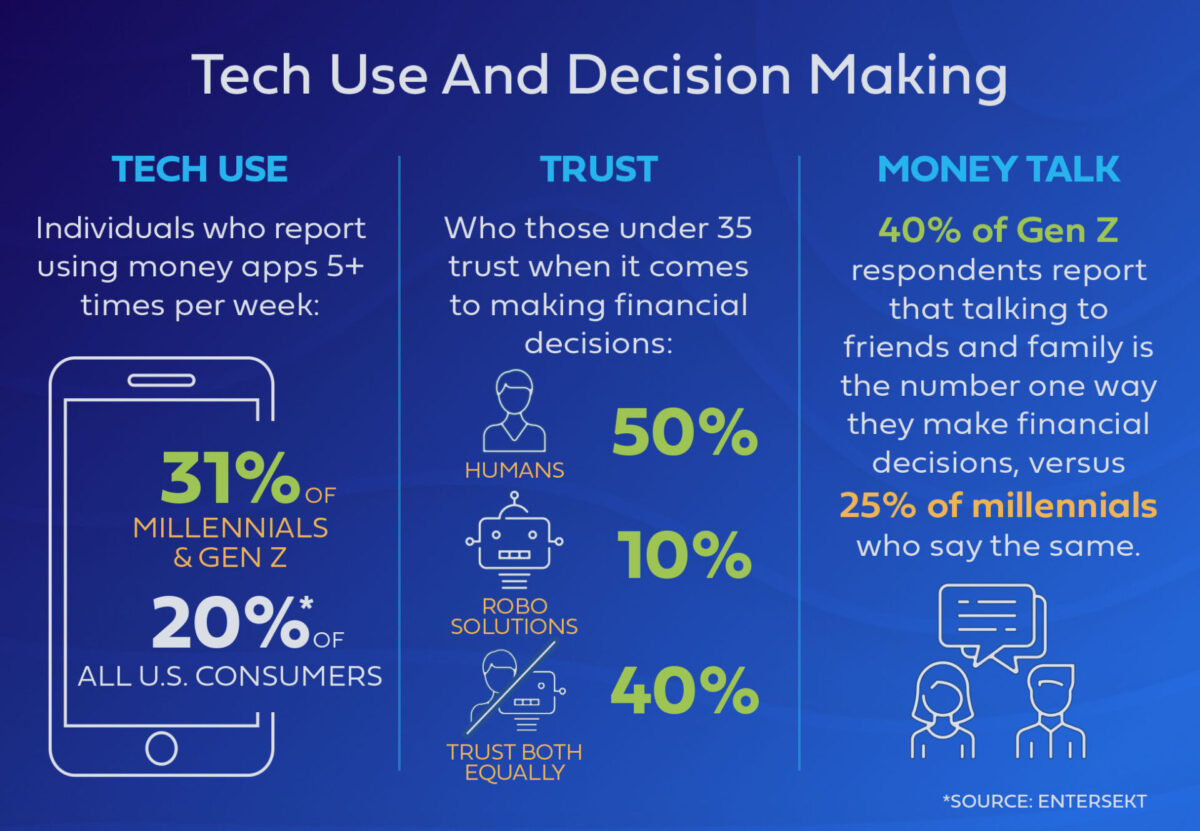

In today’s digital age, technology revolutionizes how we manage our finances, making financial wellness more accessible for Millennial and Gen Z professionals. Here are some powerful ways technology can elevate your financial health:

- Budgeting Apps: Utilize tools like Mint or YNAB (You Need A Budget) to track your spending, set budgets, and achieve your financial goals. These apps provide insights at your fingertips, guiding you towards better financial wellness.

- Investment Platforms: Platforms such as Robinhood or Acorns allow you to start investing with little money and simplify the investment process. They often include features like automatic rebalancing, which helps maximize returns effortlessly.

- Financial Education Websites: Leverage online resources, such as Coursera and Udemy, to deepen your financial literacy. Acquiring knowledge about investment strategies, budgeting techniques, and debt management can empower you toward achieving financial wellness.

- Automated Savings Tools: Services like Qapital or Digit automate your savings by analyzing your spending habits and saving money for you. This gets you closer to your financial goals without the hassle.

- Personal Finance Blogs and Podcasts: Stay informed by following trusted blogs and podcasts. They offer tips, stories, and strategies shared by others who are also on the journey to financial wellness.

By integrating these technological tools into your financial strategy, you can simplify the complexities of money management and foster a brighter financial future. Embrace technology as your ally and start your journey toward financial well-being today!

Creating Passive Income Streams: The Millennial Way

In today’s fast-paced world, achieving financial wellness often means finding innovative ways to sustain and grow your income. For Millennials and Gen Z professionals, creating passive income streams offers a fantastic opportunity to build wealth while enjoying greater flexibility. Here’s how you can start:

- Invest in Real Estate: Consider rental properties or real estate crowdfunding platforms. Owning property can generate monthly rental income without the daily hustle.

- Dividend Stocks: Invest in companies that pay dividends. These stocks provide you with ongoing income, allowing you to benefit from both share price appreciation and cash flow.

- Create an Online Course: If you possess specialized knowledge, share it! Platforms like Udemy or Teachable enable you to monetize your expertise and earn money every time someone enrolls.

- Write a Blog or eBook: Your passion can turn into revenue. Use affiliate marketing or direct sales to generate income from your writing.

- Peer-to-Peer Lending: Engage in platforms that allow you to lend money to individuals or businesses. This potentially yields higher returns compared to traditional savings.

Why Passive Income Matters for Financial Wellness

Creating passive income streams not only enhances your cash flow but also contributes significantly to your financial wellness by:

- Providing Financial Security: Stability in income sources, especially in uncertain times.

- Boosting Savings and Investments: Additional income can accelerate your saving and investing efforts.

- Reducing Financial Anxiety: A diversified income reduces reliance on a single paycheck.

Embrace these strategies, and watch how they pave the way for your long-term financial wellness!

The Power of Financial Goals: Dream Big, Achieve Bigger

Setting financial goals serves as a cornerstone for your financial wellness journey. When you dream big and set concrete objectives, you pave the path toward financial stability and independence. Here’s how you can harness this power effectively:

Benefits of Setting Financial Goals

- Clarity and Focus: Goals give you clear direction and help prioritize your financial decisions.

- Motivation: They inspire you to take actionable steps towards achieving your aspirations.

- Measurement: Goals enable you to track your progress and celebrate small victories along the way.

Types of Financial Goals

- Short-term Goals (1-2 years)

- Save for a vacation

- Build an emergency fund

- Pay off credit card debt

- Medium-term Goals (3-5 years)

- Save for a car

- Start a side business

- Buy a home

- Long-term Goals (5+ years)

- Retirement savings

- Fund children’s education

- Achieve financial independence

Achieving Your Goals

To translate your aspirations into reality, financial wellness requires a strategic approach:

- SMART Goals: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound.

- Budgeting: Allocate resources effectively to prioritize your goals.

- Regular Review: Reassess and adjust your goals as your life circumstances change.

By dreaming big and setting focused financial goals, you can elevate your financial wellness and transform your aspirations into accomplishments. Your dreams are within reach—start planning today!

Overcoming Financial Anxiety: Strategies for Peace of Mind

In today’s fast-paced world, financial anxiety can loom large, especially among Millennial and Gen Z professionals. However, achieving financial wellness is entirely possible with proactive strategies. Here are some effective ways to reclaim your peace of mind:

- Acknowledge Your Feelings: Understanding that it’s normal to feel anxious about finances is the first step. Recognizing your emotions helps in addressing them directly.

- Create a Budget: A well-crafted budget acts as a financial blueprint. It allows you to see your income and expenses clearly, reducing uncertainty.

- Establish an Emergency Fund: Setting aside 3-6 months’ worth of expenses provides a cushion against unexpected costs. Knowing you have backup funds alleviates stress considerably.

- Educate Yourself: Financial literacy is a cornerstone of financial wellness. Take time to learn about personal finance, including investment options and debt management strategies.

- Set Realistic Goals: Break down your financial aspirations into manageable milestones. Celebrate small victories along the way to maintain motivation and focus.

- Leverage Technology: Use financial apps to track expenditures, investments, and savings. These tools simplify your financial journey and reduce anxiety around managing money.

By incorporating these strategies, you can navigate your finances more confidently, ultimately fostering a greater sense of financial wellness and tranquility in your life. Embrace your journey towards financial mastery—your future self will thank you!

Frequently Asked Questions

What does financial wellness mean for Millennials and Gen Z?

Financial wellness for Millennials and Gen Z reflects a state of being where individuals feel secure and empowered in managing their finances. It encompasses understanding financial concepts, making informed decisions, and cultivating positive financial habits. Given the unique economic challenges faced by these generations, such as student debt and housing costs, achieving financial wellness means setting realistic financial goals, budgeting effectively, and building a healthy relationship with money that supports their life aspirations and mental well-being.

How can I start budgeting effectively as a Millennial or Gen Z professional?

Starting an effective budgeting process involves creating a clear picture of your income and expenses. Begin by tracking your spending for a month to identify patterns. Use budgeting apps or a simple spreadsheet to categorize expenses and set limits. Prioritize needs over wants, and allocate funds for savings and debt repayments. Remember, it’s essential to revisit your budget regularly, adjusting it as your financial situations and goals change. This journey will not only help you manage your money better but also instill confidence in your financial decisions.

What are some good saving strategies for young professionals?

For Millennials and Gen Z, effective saving strategies can transform their financial future. Start by establishing an emergency fund that covers at least 3-6 months of expenses. Utilize high-yield savings accounts to take advantage of better interest rates. Automate your savings by setting up direct deposits into your savings account right after you receive your paycheck. Additionally, consider the 50/30/20 rule, where 50% of your income goes to needs, 30% to wants, and 20% towards savings and debt repayment. These habits build a solid foundation for financial stability and prosperity.

Please click here to buy detailed books about saving strategies for young professionals from Amazon.

How does student debt impact financial wellness, and what can I do about it?

Student debt can be a significant burden, affecting both financial wellness and mental health. It’s essential to understand the terms of your loans and explore repayment options, such as income-driven plans or potential loan forgiveness programs. Consider strategies like refinancing if it reduces interest rates. Proactively managing your debt alongside other financial goals fosters a balanced approach. Connect with financial advisors or online resources for tailored advice, empowering you to tackle debt effectively while also investing in your future.

What resources are available to help me improve my financial literacy?

Improving financial literacy is an empowering journey, and there are numerous resources available for Millennials and Gen Z. Explore online platforms like Coursera or Khan Academy that offer free courses in personal finance and investing. Follow credible financial blogs and podcasts to stay updated on tips and trends. Consider joining local workshops or community-based financial literacy programs. Engaging with financial literacy games and apps can also make learning fun and interactive. The key is to seek information from diverse sources to foster a well-rounded understanding of financial concepts.